Dawn Covers TPL Trakker

Published in Dawn, The Business and Finance Weekly, July 13th, 2020

THEY say it’s tough to make predictions especially about the future. But the folksy aphorism is usually ignored by CEOs who have businesses to run and shares to hawk.

One of the largest technology companies in Pakistan is going public this month and its management has some forecast for potential investors: they should buy the shares of TPL Trakker Ltd at Rs. 12 apiece now, CEO Sarwar Ali Khan says, because their price will likely increase up to Rs. 20 by the end of 2020 i.e. 66 per cent return in about five months.

The country’s largest player in the vehicle and cargo tracking business aims to scoop up to Rs. 1.38 billion from the general public later this month by selling 115.7 million shares, which will constitute 49pc of the company’s post-listing shareholding.

“As the recently oversubscribed IPO of Organic Meat showed, the market has enough liquidity right now,” Mr Khan told Dawn.

TPL Trakker is offering shares at a fixed price of Rs. 12 each which is, according to the CEO, at a discount to its break-up value of nearly Rs. 14. The company doesn’t have three years of operational history that regulations require for book building. It was a listed company until 2017 when the sponsors spun off its tracking business into a standalone entity, which is now going for a fresh listing.

TPL Trakker is set to raise up to Rs. 1.4bn in the second IPO of 2020

“Our offer has been underwritten, which also reflects liquidity in the market. It’s the same community that underwrites (and invests),” he said while justifying the decision to go public at a time when the economy is contracting and the immediate future is uncertain.

Investors will initially bid for 83.4m or 40.9pc of the post-IPO shareholding in what is called the base issue. If it’s oversubscribed, the company will exercise the green-shoe option, which means it will offer additional 32.3m shares at the same price to raise extra Rs. 387.8m.

‘Bridging the IPO’

The IPO is yet to take place, but the company has already spent the expected proceeds. It issued a commercial paper of Rs. 1.23bn on Jan 16 to “bridge the proceed utilisation” of the IPO. It means that funds generated from the general public will mainly be used to repay the commercial paper.

This raises a few questions: wasn’t it poor planning on part of the company to first issue a commercial paper and then hold an IPO in just six months to pay it back? Wasn’t the decision also ill-timed as the debt instrument had a 16pc rate of return given the high interest rate prevailing at the time? Couldn’t the company save almost Rs. 90m that it will now have to pay as debt servicing out of the IPO proceeds?

“These are older borrowings. Equity is more expensive than debt especially when interest rates are down. Kibor shot up last year. That’s when we decided this was no longer sustainable, especially when we were on a growth path. That’s why we went for the IPO,” said Malik Sheheryar, company’s chief financial officer.

“The IPO wasn’t ill-planned. In fact, it is exactly right now that it should have been happening. It’s now going to start replacing and rationalising the debt. We’re not relying on interest rates staying low. We’re going to deleverage,” he added.

As for the utilisation of IPO proceeds, more than half of the generated funds will go back to the holding company. TPL Trakker will settle the loan of Rs. 700m that it owes to TPL Corp Ltd (assuming the green-shoe option is exercised).

The rest of the funds will be utilised for IT capital expenditure, digital mapping equipment, procurement of electronic devices, working capital and the servicing cost of the commercial paper.

The company officials vehemently defended the use of IPO proceeds mainly to settle a loan from the parent company.

“The holding company doesn’t have the earning capacity itself. We’re replacing borrowing across the group with equity. The holding company put in that money because our growth path required it,” the CFO said.

“Our requirements were such that we didn’t want to wait for IPO proceeds. Our maps product had a very quick requirement of finances. Banks are more interested in lending to people who have physical assets. The holding company has full confidence in the company. That’s why it lent us money by borrowing itself,” he said.

The company’s revenue inched up 6pc in 2018-19 to Rs. 1.77bn, which was smaller than top-line growth recorded in the years before the 2017 demerger. The officials attributed this slowdown to the steep increase in interest rates. “Our reliance at the time was on the auto sector. We launched the mapping business in January 2020,” Mr Malik said.

Similarly, net profit decreased by 62.8pc in 2018-19 to Rs. 36m. The management attributed it to the high finance cost. The company’s debt-to-equity ratio was 132pc while cash flows from operating activities amounted to Rs. 56m, down 60pc from a year ago.

Business amid pandemic

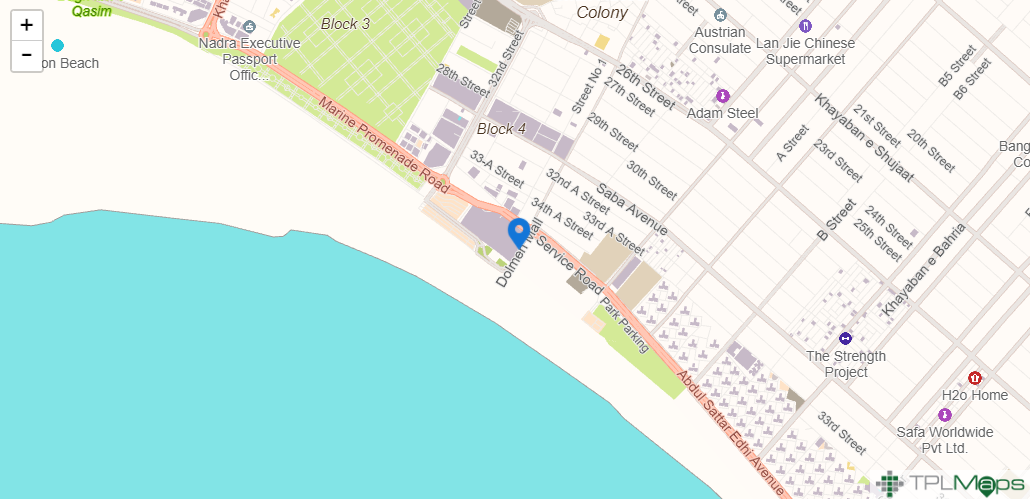

Mr Khan said the pandemic-induced recession had actually helped the company grow business because of the peculiar nature of its products. Big home-delivery companies like Foodpanda now use TPL Maps instead of Google Maps, he said.

It continues to make recurring revenue in the vehicle-tracking segment on each of its 130,000 active portfolios. Mr Khan expected growth in car sales to resume in 12-18 months as the benchmark interest rate had gone down substantially and new automakers had entered the market.

“In 2020-21, we expect to go from (tracking) 10,000 containers per month to up to 16,000,” he said. The company tracks container cargo going from Pakistan to Afghanistan as well as the China-bound cargo leaving the Gwadar port. In addition, it has received a licence to track containers coming from Afghanistan to Pakistan. It is in the process of obtaining a separate licence to track transhipment cargo – containers that move from seaports to dry ports within the country.

“Compared to the region, the share offer is at a 30-80pc discount. This is the best time to invest in a tech company,” said Mr Malik.

The post Dawn Covers TPL Trakker appeared first on TPL Trakker Ltd..